Business

A 5-Step Plan to Help Your Business Succeed

Sharing your plan with stakeholders in a transparent manner helps build a sense of ownership and allows you to truly understand their concerns. This step also gives you a chance to adjust your plan to secure their commitment before locking it down.

By creating a contingency plan, you can better address risks to your business and fast-track disaster recovery. This is a great way to help your team stay focused and on track.

1. Identify Your Goals

Whether your business is a startup or an established company, you need goals. Without goals, you may find yourself going in a number of different directions without a clear idea of where you want to end up.

When creating goals, make sure that they are specific, measurable, attainable, and relevant. This will help you keep your focus on what matters and will let you know when you have reached your goal.

Identifying your goals is only half the battle, though. You must also create a plan to achieve them. This means breaking your overarching goals down into small action steps that you can take each day. This will allow you to experience small victories along the way and keep you motivated to reach your goal.

3. Develop a Marketing Plan

Developing a marketing plan allows you to see your goals come to life and helps ensure that you are spending time and resources wisely. This process identifies your strengths and weaknesses, outlines a strategy to attract customers, and provides the framework to measure results.

Once you have a clear strategy, the next step is to develop the tactics that will achieve your strategy. For example, if your strategy is to improve customer retention, you may need to set up a monthly outbound call campaign. This requires you to configure teams, implement a call script, and establish a system to escalate calls.

Creating an audience-centric framework enables you to coordinate your campaigns and maximize the value of each marketing effort toward a single, cohesive strategy. This ensures higher engagement and fuels business growth.

4. Set Goals for Your Team

To help ensure that each member of your team is working towards their contribution to the overall business goal, you must set individual and team goals crew logout. These should be specific, measurable and attainable. It’s important that these goals are linked to the larger company goal but should be differentiated from it by the tasks involved.

Using the SMART system (Specific, Measurable, Attainable, Relevant and Time-bound) for setting goals can help with this, but it’s also necessary to ensure that any timelines you set are realistic. You can also encourage the team to achieve their goals by tying them to incentives.

However, it’s important to regularly review and adjust these goals as circumstances change. This will prevent your team from wasting time on an ineffective project.

5. Create a Contingency Plan

Creating a contingency plan forces business leaders to consider every potential threat and its impact, giving them a more methodical approach to prevention, resolution, and bounce-back. It’s also important to make sure that all of your staff members are aware of the plans and know their responsibilities.

Start by identifying the critical areas of your business that keep it up and running on a daily basis. Next, prioritize the threats according to their impact and probability. Lastly, create an action plan for each risk that details how your team will respond.

Use ClickUp’s whiteboard template to collaboratively plan out all of your risks and strategies in one place. Be sure to review and update the plans on a regular basis, taking into account any lessons learned from internal or external incidents, as well as new challenges that may arise.

Business

How Many Oz Is a Gallon Simple Conversion Explained Clearly

Okay, so let’s talk about something that’s been surprisingly confusing for a lot of people, including me back in the day: how many oz is a gallon. Seriously, it sounds simple, right? A gallon, ounces… boom, done. But nope. Once you get into the details, suddenly your brain does a backflip. I remember staring at a recipe as a teenager thinking, “Do I seriously have to measure all this? Isn’t there an easier way?”

Anyway, let’s untangle this mess, step by step, and I’ll try to make it fun. Maybe even funny. And maybe a little messy, ‘cause life’s messy, right?

What Exactly Is a Gallon?

Before we dive into ounces, let’s take a quick detour into gallons.

- A gallon is basically a way to measure liquid.

- In the U.S., a gallon is different from a UK (imperial) gallon. That threw me off for years. I mean, who knew? One country’s gallon isn’t another’s? Wild.

The U.S. Gallon vs. The UK Gallon

I’ll keep this simple:

- U.S. gallon: 128 U.S. fluid ounces

- UK gallon (imperial): 160 U.K. fluid ounces

Honestly, I remember trying to pour a “gallon” of lemonade for a school fair and ended up with way too little. Felt like I was being pranked by the universe.

So yeah, if you’re in the U.S., remember the magic number: 128 ounces in a gallon. That’s the one most recipes and cooking tips go by.

Why Knowing How Many Oz Is a Gallon Matters

You might wonder, “Do I really need to know this?”

- Cooking and baking: Nothing ruins cookies faster than mismeasuring liquids. Trust me, I learned that the hard way when I dumped half a gallon of milk into chocolate chip cookies. Disaster.

- DIY projects: Making soap, paint mixes, or even cocktails. All those little oz measurements stack up fast.

- Travel & camping: Imagine trying to carry a gallon of water. It helps to know how many ounces you’re actually dealing with.

Honestly, I feel like knowing how many oz is a gallon is one of those adulting hacks they forget to teach you in school. Straight up wild.

Quick Conversion Trick

Here’s a little trick I use when I don’t feel like pulling out a calculator:

- Remember that 1 gallon = 128 oz

- If you need half a gallon, just divide by 2 → 64 oz

- Quarter gallon? Divide by 4 → 32 oz

Super simple. I mean, I still have to double-check it sometimes because numbers and I… we have a complicated relationship.

Visual Memory Hack

I like to imagine a milk jug. You know, the big, clunky U.S. kind. Fill it up completely and imagine cutting it into 128 tiny little cups. Yeah, kinda absurd, but helps it stick in your brain.

Gallons in Everyday Life

Here’s a fun little list of how we bump into gallons all the time:

- Gasoline at the pump (I always get confused when the price is per gallon)

- Milk jugs at the grocery store (classic)

- Water for plants or pets

- Juice boxes that actually pretend to be bigger than they are

Honestly, I never thought I’d care about how many oz is a gallon until my cousin dared me to mix a gallon of punch for a party. Let’s just say the punch bowl exploded. Classic family moment.

Conversion to Other Units

Sometimes, just knowing ounces isn’t enough.

- 1 gallon = 128 oz

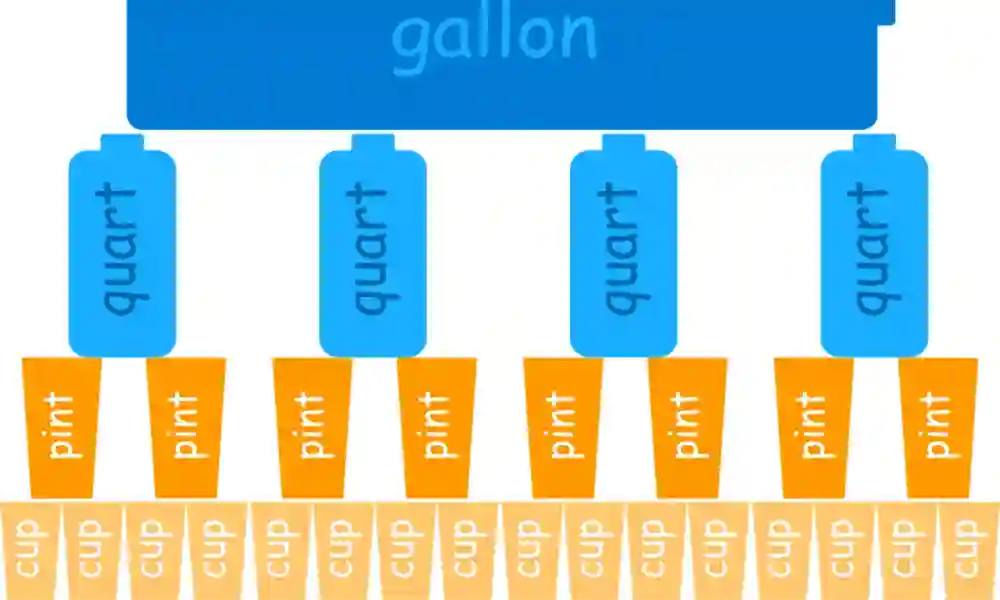

- 1 gallon = 4 quarts

- 1 gallon = 8 pints

- 1 gallon = 16 cups

Crazy how all these little units fit into each other. Reminds me of that scene in House of Leaves, where nothing is what it seems… spooky stuff, but with liquids.

Fun Fact Break: History of the Gallon

Did you know that gallons used to vary depending on what you were measuring?

- Wine gallon vs. ale gallon vs. corn gallon. I mean, seriously, people back then were just improvising with volume.

- The U.S. finally standardized the gallon in the 19th century. Thank goodness, otherwise I’d probably still be guessing how many ounces are in a gallon while making soup.

How Many Oz Is a Gallon – Quick Reference

Let’s make it really simple for you:

- U.S. liquid gallon = 128 oz

- U.S. dry gallon = 148.946 oz (yeah, weird, I know)

- Imperial gallon = 160 oz

Honestly, every time I write these numbers down, I spill a little coffee on the page. Classic me.

Measuring Tips

Here are a few practical tips I’ve learned:

- Use the right measuring cup – Fluid ounces only, not dry ounces

- Level your measurement – Eyes at the liquid line

- Break it down – Half gallons, quarter gallons, whatever works

I remember trying to eyeball a gallon for lemonade as a kid. Result? Lemonade lake. Learned my lesson.

Common Mistakes People Make

Let me save you some headaches:

- Mixing up U.S. and U.K. gallons

- Confusing fluid ounces with weight ounces (yes, different things)

- Thinking a gallon is just “a lot of stuff” without measuring

I’ve been guilty of all three. My kitchen looked like a science experiment gone wrong.

Fun Calculations

Want to impress friends? Try this:

- 1/2 gallon = 64 oz

- 1/3 gallon ≈ 42.67 oz

- 1/4 gallon = 32 oz

Honestly, I still need a calculator for the weird fractions. But hey, now you know how many oz is a gallon in all the messy little ways.

DIY & Crafts

If you’re into crafts or DIY stuff, gallons are everywhere:

- Mixing paints or resins

- Homemade cleaning solutions

- Bath bombs (don’t ask, long story)

And yes, you really need to know how many oz is a gallon. Otherwise, you’re just guessing. I tried once… didn’t end well.

When Traveling Abroad

Remember, not all gallons are created equal:

- U.S. gallon = 128 oz

- UK gallon = 160 oz

Imagine trying to fill up a rental water container overseas thinking you’re filling a gallon… totally wrong. Felt kinda weird seeing everyone stare at me while I dumped water like a confused circus act.

Quick Mental Math Hacks

- Think 128 as 4×32 → makes it easier to split

- Half gallon = 64 oz

- 1/4 gallon = 32 oz

Honestly, I still forget these numbers sometimes. My brain is like, “128 what now?”

The Final Takeaway

So, in case you’ve skimmed: how many oz is a gallon?

- U.S. liquid gallon = 128 oz

- UK gallon = 160 oz

- Dry gallon = 148.946 oz

If you can remember the U.S. liquid gallon number, most cooking, baking, and DIY projects will be safe.

Random Life Connection

I know it’s random, but measuring liquids always reminds me of summer camping trips. My dad would fill a gallon jug of water, and we’d end up arguing over who drank more. We’d measure ounces just to make it “fair.” Classic family nonsense.

Wrapping Up

Honestly, how many oz is a gallon isn’t complicated once you get it down. U.S. = 128 oz. UK = 160 oz. Dry = ~149 oz.

- Break it into halves or quarters

- Use the right cups

- Remember the quirky historical tidbits for fun

And next time you’re pouring a gallon of anything, you’ll feel like a pro… or at least like someone who doesn’t totally fail at measuring.

Wrote this paragraph by hand. Then spilled coffee on it. Classic.

There you have it, a messy, fun, and hopefully memorable guide on how many oz is a gallon. I tried to keep it human, a bit chaotic, and maybe even relatable.

Business

Beyond the Boardroom: Business Consulting in Diverse Industries

The landscape of business consulting has expanded far beyond the confines of traditional boardrooms, reaching into the diverse tapestry of industries that shape our global economy. As the needs and challenges of organizations evolve, so too does the role of consultants who find themselves navigating the complexities of sectors as varied as technology, healthcare, finance, and beyond. This article explores the dynamic realm of business consulting across diverse industries, highlighting the versatility and adaptability that consultants bring to the ever-changing landscape of modern business.

The Changing Face of Business Consulting

Gone are the days when consulting was primarily associated with management strategies confined to the boardroom. Today, business consultants find themselves engaged in an array of industries, each with its unique set of challenges and opportunities. The expansion of consulting into diverse sectors reflects the recognition that effective strategies are not one-size-fits-all and that industry-specific expertise is crucial for success.

Technology: Pioneering Innovation

In the fast-paced world of technology, where innovation is the lifeblood of progress, consultants play a pivotal role in guiding organizations through transformative change. From advising startups on market entry strategies to assisting established tech giants in navigating disruptions, technology consultants are at the forefront of driving innovation.

Technology consultants delve into areas such as digital transformation, cybersecurity, and artificial intelligence. They assist organizations in harnessing the power of emerging technologies to optimize operations, enhance customer experiences, and stay ahead in competitive markets. In the tech industry, consultants serve as catalysts for change, helping businesses adapt to the rapid evolution of digital landscapes.

Healthcare: Navigating Complexities

The healthcare sector, with its intricate regulatory frameworks and evolving patient-centric models, presents unique challenges that demand specialized consulting expertise. Healthcare consultants collaborate with hospitals, pharmaceutical companies, and healthcare providers to optimize operational efficiency, improve patient outcomes, and navigate complex regulatory landscapes.

From implementing electronic health records to designing patient-centered care models, healthcare consultants bridge the gap between medical expertise and operational efficiency. They contribute to the ongoing transformation of the healthcare industry, ensuring that organizations deliver high-quality care while adapting to the ever-changing healthcare landscape.

Finance: Navigating Risk and Compliance

In the world of finance, consultants are instrumental in navigating the complexities of risk management, compliance, and strategic financial planning. Financial consultants guide organizations through regulatory changes, help manage financial risks, and optimize financial processes to enhance overall efficiency.

From advising investment firms on market trends to assisting banks in implementing fintech solutions, consultants in the finance sector are indispensable partners in an industry where precision and adaptability are paramount. Their expertise extends beyond traditional financial models, encompassing emerging trends such as blockchain and sustainable finance.

Manufacturing: Operational Excellence

In the realm of manufacturing, consultants focus on achieving operational excellence, optimizing supply chains, and implementing lean methodologies. Manufacturing consultants work with organizations to streamline production processes, enhance quality control, and adapt to industry 4.0 technologies.

By leveraging their expertise in efficiency and process improvement, consultants contribute to the competitiveness of manufacturers in a global market. They play a crucial role in helping organizations adapt to new technologies, such as automation and robotics, to drive innovation and maintain a competitive edge.

Retail: Adapting to Consumer Trends

Retail consultants operate in a dynamic landscape shaped by shifting consumer behaviors and emerging e-commerce trends. They assist retailers in understanding market dynamics, optimizing their omnichannel strategies, and adapting to the evolving expectations of consumers.

Retail consultants contribute to the development of personalized customer experiences, implement data-driven marketing strategies, and guide organizations in navigating the challenges of digital transformation. Their insights help retailers stay agile in an industry where adaptability is key to success.

Energy: Navigating Sustainability

As the world grapples with the imperative of sustainability, consultants in the energy sector are at the forefront of guiding organizations through the transition to cleaner and more sustainable practices. Energy consultants work with companies to develop renewable energy strategies, enhance energy efficiency, and navigate regulatory landscapes.

In an industry undergoing a profound shift towards sustainability, consultants play a crucial role in helping organizations balance environmental responsibility with operational efficiency. Their expertise extends to areas such as renewable energy integration, carbon footprint reduction, and the adoption of innovative technologies in the energy sector.

Cross-Industry Expertise: The Versatility of Consultants

While specialized industry knowledge is crucial, the versatility of consultants lies in their ability to apply cross-industry expertise. Consultants often bring insights from diverse sectors to their clients, facilitating the cross-pollination of ideas and innovative solutions. The ability to draw parallels between seemingly disparate industries allows consultants to offer fresh perspectives and creative problem-solving approaches.

The cross-industry expertise of consultants is particularly valuable in addressing complex challenges that transcend sector boundaries. Whether it’s integrating technology in healthcare, implementing sustainability practices in manufacturing, or enhancing customer experiences in finance, consultants with a diverse skill set can bridge gaps and drive holistic solutions.

The Future of Diverse Industry Consulting

As the business landscape continues to evolve, the future of diverse industry consulting looks promising. The need for consultants who can navigate the unique challenges of specific sectors while leveraging cross-industry insights is likely to increase. The adaptability and versatility of consultants will be crucial as organizations seek guidance in an era marked by rapid technological advancements, changing consumer expectations, and a growing emphasis on sustainability.

Business

5 Secret Techniques to Improve Business Growth

If you want your business to grow, there are certain improvements you should make. Not all of them are obvious, and even if you streamline just one area, it could impact the rest of your company.

Apply these 5 secret techniques to improve your business: 1. Identify and Understand your Customers.

1. Develop a Strong Marketing Strategy

Developing a strong marketing strategy is a crucial element in the success of your business. It can be a challenging task, but it is important to have a clear plan for how to market your product or service.

The first step in developing a strong marketing strategy is to identify your target audience. This can be done by conducting a competitor analysis or by studying the demographics of your target market.

Once you have a clear idea of who your target market is, it’s important to create messages that will resonate with them. For example, you can use a personalized message when contacting your customers to show that you care about them. This will help to build brand loyalty and increase sales. This is also known as customer centric marketing.

2. Create a Strong Customer Relationship

Strong customer relationships drive brand loyalty, encourage repeat purchases and boost a company’s customer lifetime value (CLT). In addition, they help you develop a more effective marketing strategy.

One of the best ways to build a strong customer relationship is through communication. Whether through emails, newsletters or check-in phone calls, be sure to provide your customers with regular updates. This will allow you to better understand your customers and address any issues that may arise.

Keeping in touch with your customers also shows that you care about them. Providing them with personalized experiences, like calling them by name, helps to build trust and loyalty. This is an excellent way to stand out from your competitors. Moreover, it also shows that you value your customer’s feedback and want to improve upon their experience.

3. Invest in Your Employees

Employees are the backbone of every business. They are responsible for delivering the products and services to customers, which is why it’s important to invest in your employees. This includes fostering an environment that encourages growth and providing them with opportunities to build their network.

Employee turnover is costly for businesses. It can cost up to 2x an employee’s salary in recruiting, training, and lost productivity. Investing in your employees can help reduce employee turnover and improve the overall culture of your company.

Investing in your employees doesn’t have to be expensive. Even small things, like hosting monthly happy hours, can go a long way to fostering a healthy workplace culture. And don’t forget to listen to your employees and understand their needs. This will ensure that you’re investing in the right things.

4. Create a Strong Brand

Branding can increase the know, like and trust factor of a business which leads to easier sales and consumer loyalty. Branding also allows a business to differentiate itself from its competitors and is an effective way to build a competitive advantage. However, building an extraordinary brand requires organization and planning. Identifying your target market is critical as well. You should use customer profiles, also known as personas, to develop key messaging and branding that appeals to your target market.

In addition, you should be willing to invest in marketing and advertising. These strategies will help you grow your business and generate more sales. But remember, these secrets are not magic bullets and you must continue to work hard and stay focused on your goals.

5. Focus on Customer Service

Customer service is an important aspect of any business. A good customer experience can help improve a company’s reputation and increase sales. Customer focus involves putting the customer at the center of all decisions. It also involves creating a culture where employees feel like they are part of the customer service team.

Customer focus can be achieved by training your employees, providing incentives, and sharing positive customer feedback. It can also be achieved by offering personalized customer experiences and focusing on meeting customers’ needs.

A business that focuses on customer service will see increased brand loyalty and customer retention. In addition, they will be able to make better recommendations and increase revenue. It is also important to note that customers who have experienced poor customer service are more likely to switch to a competitor.

-

Business3 years ago

Business3 years agoWhat Can a Loan Calculator Do For You?

-

General3 years ago

General3 years agoSafe Play The Impact of Secure Playgrounds

-

Games2 years ago

Games2 years agoStep-by-Step Guide: How to Register on Armadatoto

-

Business10 months ago

Business10 months agoBeyond the Boardroom: Business Consulting in Diverse Industries

-

Sports3 years ago

Sports3 years agoBest Slot Machines in World and Where to Play Them

-

Games2 years ago

Games2 years agoSecuring the Bet: The Essential Role of Muktu Polis in Online Betting Safety

-

Sports2 years ago

Sports2 years agoExploring the World of Online Gaming: A Comprehensive Review of TMTPLAY Casino Philippines

-

Automotive3 years ago

Automotive3 years agoAfter a Bike Accident, What Are Your Legal Options?